Compound interest calculator for lump sum

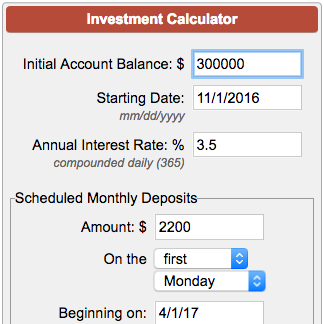

The above calculator compounds interest monthly after each deposit is made. To calculate the future value of a monthly investment enter the beginning balance the monthly dollar amount you plan to deposit the interest rate you expect to earn and the number of years you expect to continue making monthly deposits then click the Calculate.

How To Calculate Compound Interest For Deposits And Repayments Interest Rates Mozo

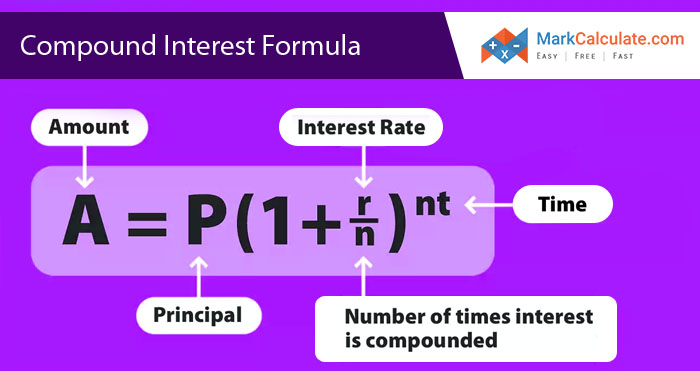

A P 1 rn nt.

. Life Insurance Calculator Life Insurance Guides Home Insurance Calculator. This kind of loan is rarely made except in the form of bonds. Answer the question How much would I like to have saved up by a certain time in my life Enter the dollar amount as the future lump sum.

Predetermined Lump Sum Paid at Loan Maturity. But may not be suitable if you have a large lump sum to deposit initially. By Richard Browning For Thisismoneycouk.

Savings Calculator This one takes a lump sum of money and compounds it monthly over a fixed period of time at a fixed annual yield. To calculate compound interest we use this formula. 11 instead of 11.

The compound interest equation basically adds 1 to the interest rate raises this sum to the total number of compound periods and multiplies the result by the principal amount. If you would like to know how much interest your investment will earn our compound interest calculator can help. Years Percent Yield Initial Balance Monthly Contribution Results.

Its designed so that you can enter one single initial sum or a single initial sum following by regular monthly payments or regular monthly payments with no initial investment. This allows exponential growth for your interest. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

This is a compound interest calculator savers can use to get an idea of how. Most bank savings accounts use a daily average balance to compound interest daily and then add the amount to the accounts balance. With compound interest and an initial savings balance of 5000.

And when youre done calculating present values then put that knowledge to use in this free 5-part video series showing you 5 Rookie Financial Planning Mistakes That Cost You Big-Time. Use the Compound Interest Calculator to learn more about or do calculations involving compound. Compounding interest means interest on interest.

It is the result of reinvesting interest or adding it to the loaned capital rather than paying it out or requiring payment from borrower so that interest in the next period is then earned on the principal sum plus previously accumulated interest. Ways of using a lump sum include. A contract is forged where they hold your money for a guaranteed period of time.

The compound interest calculator gives the total investment wealth gained and maturity value both in number and in graphical format. N represents the number of periods. In short the power of compounding calculator shows the maturity value of a lump sum investment at the end of a specified period at a specific rate of return.

Put Inputs Here. Plus it allows you to add monthly contributions. Our calculator compounds interest each time money is added.

Enter it as a percentage value ie. If the account has a lump-sum initial deposit does not have any periodic deposit by default interest is compounded daily. P Present value.

In a lump-sum contract the owner has essentially assigned all the risk to the contractor who in turn can be expected to ask for a higher markup in order to take care of unforeseen contingencies. If you initially had 5000 saved up and wanted to deposit 1000 at the beginning of the second year then you would set the initial deposit amount to 4000 as the other 1000 would automatically be added at the. Compound interest is the addition of interest to the principal sum of a loan or deposit or in other words interest on principal plus interest.

This calculates how your savings will grow over time and the impact of compound interest. Lumpsum calculators use a specific formula to compute the estimated returns on investments. Depending on your funds rules you may be able to withdraw some or all of your superannuation super as a lump sum.

The power of compound interest means you earn interest on interest. This calculator will help you to determine the future value of a monthly investment at various compounding intervals. If so you can take all your super in one go or as several lump sum payments.

Deposits are made at the beginning of each year. Subtract the initial balance if you want to know the total interest earned. Use our lump sum savings calculator to work out how much your savings could be worth in the future.

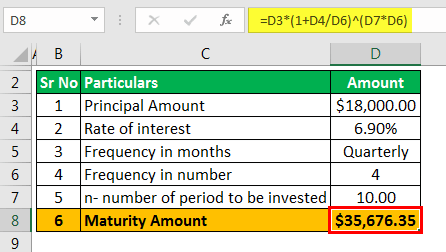

I represents the rate of interest earned each period. Adjust the lump sum payment regular contribution figures term and annual interest rate. Lumpsum Calculator Formula to calculate mutual fund returns.

PV represents the present value of the investment. Youll find this extremely useful when trying to project what your assets may be worth in the future. The calculator uses compound interest calculations on future values and includes several compounding periods including annual semi-annually monthly weekly and daily to solve the total interest on your investment.

FV represents the future value of the investment. Easy access savings accounts wont typically pay the. Each time you earn interest on your principal it is added to the original amount which then becomes the principal for the next cycle.

Work out interest and investment returns on lump sums and regular monthly saving. If you want to calculate the present value of a stream of payments instead of a one time lump sum payment then try our present value of annuity calculator here. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods.

It is a compound interest formula with one of the variables being the number of times the interest is compounded in a year. You also agree to add scheduled monies over the duration of the investment. This lets us find the most appropriate writer for any type of assignment.

Clearing debt for example paying off your mortgage investing for your. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan. Present Value Discount Rate.

In exchange they pay you a set interest rate. Fixed rate bonds - a fixed rate of interest for. Here A estimated returns.

If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. How a superannuation lump sum works. The above calculator compounds interest yearly after each deposit is made.

Compound interest is calculated using the compound interest formula. How to calculate compound interest. Once the investment matures you receive a lump-sum payment that is exponentially larger than your original and subsequent payments.

Compounding interest can be good or bad depending on whether you are a saver or a borrower respectively. FV PV x 1 in where. Considering the above example where Mr.

Technically bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. A lump-sum contract or a stipulated sum contract will require the supplier agreeing to provide specified services for a stipulated or fixed price. Use the interest rate at which the present amount will grow.

You may also be interested in our monthly savings calculator. How Interest is Compounded.

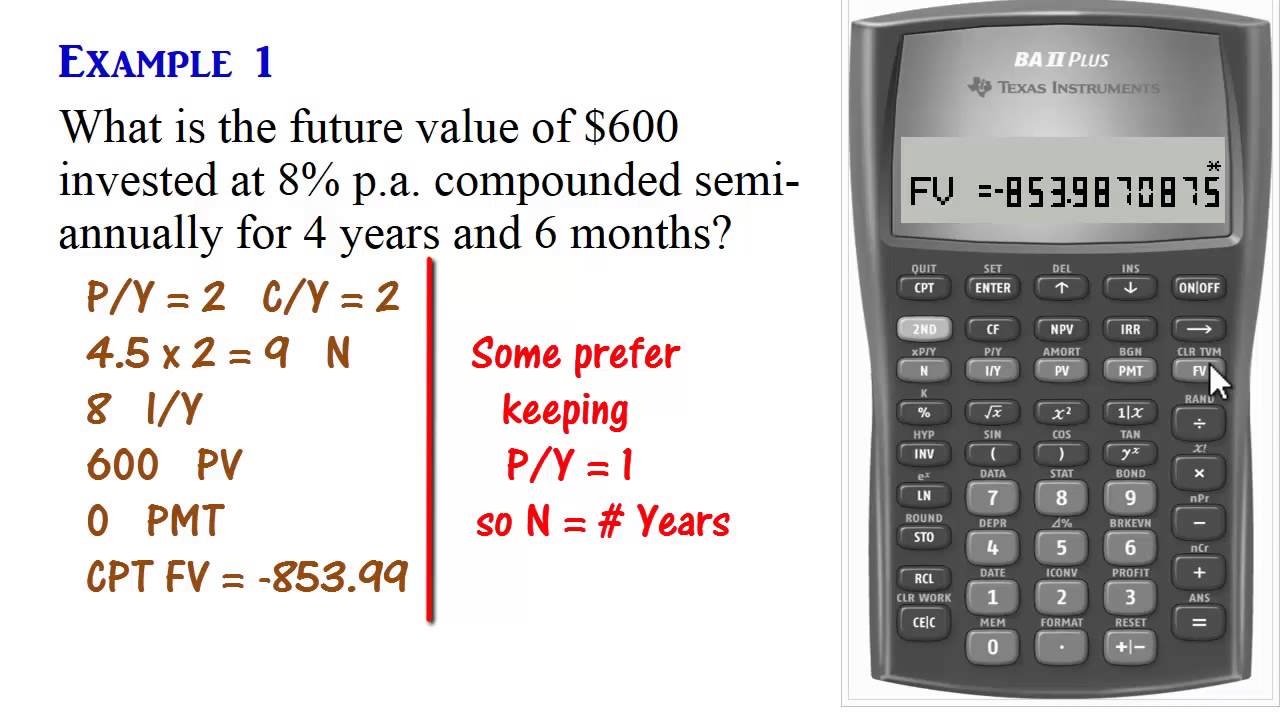

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

15k Savings Plan In 2022 Money Saving Methods Money Saving Techniques Money Saving Strategies

Compound Interest Calculator Calculate Compound Interest Online Dhan

Simple Interest Vs Compound Interest Top 8 Differences To Learn Simple Interest Compound Interest Maths Solutions

What Is A Personal Allowance Income Tax Capital Gains Tax Personal Savings

Compound Interest Calculator Calculate Compound Interest Online Dhan

Compound Interest Calculator Markcalculate

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Calculator With Formula

Compound Interest Calculator Financeplusinsurance

Cagr Calculator For Stocks Index Mutual Funds Fd Calculate In 3 Easy Steps Financial Instrument Mutuals Funds Systematic Investment Plan

Investment Calculator Calculate Amount Earned On Initial Investment

Investment Account Calculator

Compound Interest Calculator Calculate Compound Interest Online Dhan

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Calculator For Excel

Compound Interest Calculator Calculate Compound Interest Online Dhan